An Assessment of the 2022 Turkish Economy: Is Inflation the Main Actor?

Statistics from the World Bank and TURKSAT showed that Turkey’s gross domestic product growth has been strong and resilient after the pandemic.

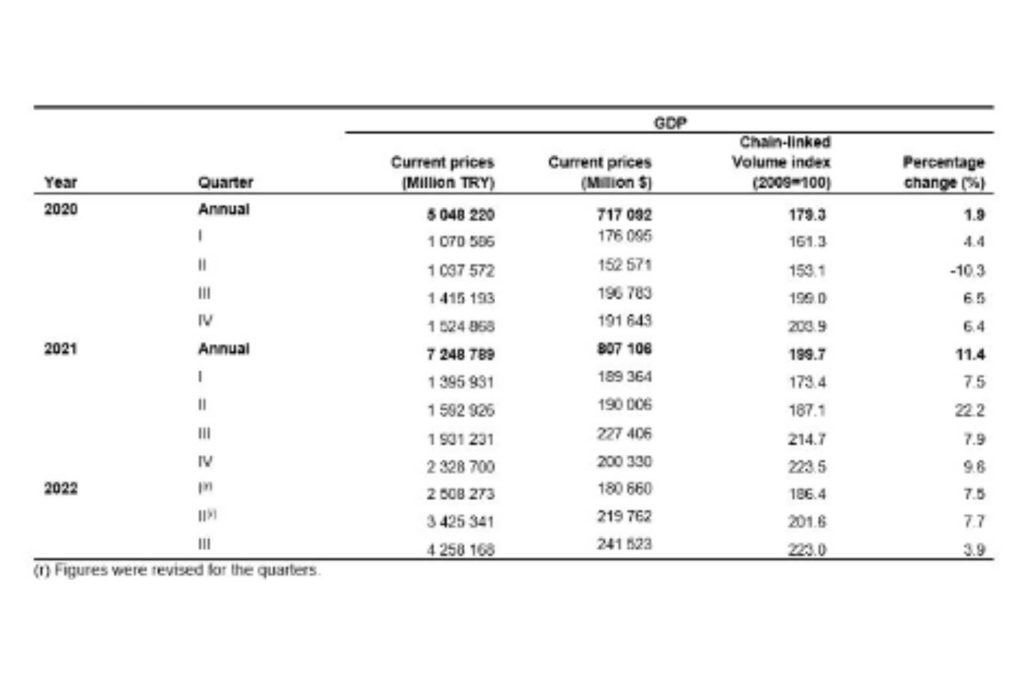

2022 was a defining year for economies around the world. Economic recovery has not been easy, especially for most emerging and developing countries. Turkey also experienced the negative economic effects of the pandemic. However, statistics from the World Bank and TÜRKSAT showed that Turkey’s gross domestic product growth was strong and resilient after the pandemic. The percentage change of GDP increased significantly (11.4%) in 2021 compared to 2020. In the first quarter of 2022, there was a positive change in GDP, but the trend was slow. This was because the Russian-Ukrainian war hit the Turkish economy again due to the energy crisis. Instead of the health crisis and the energy crisis, Turkey experienced the return of inflation and the Turkish Lira depreciated significantly against the Dollar. In December 2022, the consumer price index was recorded at 64.27%, an annual change of 36.08% compared to 2021. The volatility of the CPI had a direct impact on vulnerable groups in Turkish society, especially as wages remained unchanged in the face of this increase in inflation. Given that price stability is the mission of central banks, what measures has the Central Bank of the Republic of Turkey taken in the face of this economic turmoil? In light of the highest inflation records and high cost of living, will President Erdoğan be re-elected as the presidential elections approach?

Turkey’s economic outlook in 2022

Turkey is one of the countries with the fastest recovery and recovery from the pandemic. According to the OECD, real gross domestic product (GDP) grew by 7.5% in the first half of 2022. Real GDP growth has been particularly strong and resilient in the last two years, despite multiple external influences (shocks) from the Covid-19 pandemic in 2020 and more recently the war in Ukraine. Global economic activity is again facing multiple shocks due to the energy crisis in Europe, the Covid zero policy and the economic slowdown in the US. However, despite these significant headwinds, the Turkish economy is expected to remain resilient in the short term. On the other hand, inflation in Turkey is returning after nearly 20 years. Inflation recorded its highest levels in 2022. In economic theory, there are many reasons that emphasize inflationary tensions. In the case of Turkey, the currency crisis fed the Consumer Price Index. The Turkish Lira depreciated significantly against the Dollar. In 2021, 1 dollar corresponded to 8 liras, while in the period up to today it has reached 19 liras. Not only were inflationary pressures driven by domestic factors, but the international context exacerbated the situation. High food and energy prices largely explain the price instability in the country.

Despite macroeconomic volatility, 2022 was marked by strong economic growth in the country. This growth was driven by an increase in exports and foreign demand, while the recovery in exports led to higher economic growth in the same year. The acceleration in the export trend reduced the current account deficit. On the production side, the country recovered from the pandemic and the tourism sector also revived. This sector contributed to the increase in growth. Not to mention that Covid-19 has increased income inequalities and gender inequalities. Households, especially informal workers, lost their jobs and income because they could not benefit from the social measures implemented by the authorities during the pandemic. As a result, poverty has increased in the country, along with inflation.

The main measures taken to overcome the economic problems of the Turkish economy focused on improving the labor market. As the context is unstable with inflationary pressures directly affecting household incomes, Turkish President Recep Tayyip Erdoğan announced in December 2022 that he would increase minimum wages from January. Such policies were addressed to support vulnerable groups of society.

CBRT response: Tight monetary policy

The main task of central banks is to conduct monetary policy to control inflation. Economic and financial crises have demonstrated the importance of central banks in overcoming inflationary tensions and ensuring price stability. We distinguish between two types of monetary policy. Tight monetary policy, which involves raising interest rates to reduce inflation: an increase in interest rates limits the circulation of money throughout the economy, which in turn reduces the inflation rate. Loose monetary policy, on the other hand, is used to stimulate the economy by lowering interest rates after a recession or crisis. Lowering interest rates encourages people to borrow money and invest more, thus increasing economic growth. Central banks are also known for their independence from the government and political decision-makers. In Turkey, the situation is reversed, the Central Bank of the Republic of Turkey is no longer very independent. This can be demonstrated mainly by two features. The president’s interference in the CBRT governor’s job of setting interest rates and the dismissal of central bank governors… Economic theory has emphasized the fact that tight monetary policy is necessary in times of price instability. Yet President Erdoğan continues to lower interest rates to 9%. Many researchers have characterized the president as the “enemy” of interest rates. Presidents’ priorities are to stimulate exports, increase production and improve employment, inflation is self-regulating. Most analysts say monetary policy will probably remain steady until the 2023 elections. After that election, it will depend on whether the opposition, which has promised a return to orthodox policies and rate hikes, allows heterodox monetary policy.

Hiba Bouazza

UM6P

Comments